Year-End Transfer Pricing & Customs Valuation Tips

Rohit Sharma , Principal, Transfer Pricing

It’s hardly unusual for subsidiaries of multinational groups to find that their actual operating results aren’t aligned with the arm’s-length principle at the end of the year. The situation only gets worse when their intercompany transactions don’t line up either.

In 2015, the OECD started cracking down on international tax planning techniques used by multinationals, announcing their Base Erosion and Profit Shifting measures, commonly referred to by its acronym “BEPS”.

Tax authorities around the world are now using BEPS inspired action plans and more systematic approaches to address international tax planning techniques. To become compliant with Transfer Pricing standards, and to steer clear of tax avoidance, multinationals need to start doing the same.

There are many factors that may cause a company to deviate from the arm’s-length principle.

It could be an issue of budgeted vs. actual profit/cost levels, exceptional management cross-charge, market fluctuations, or economic circumstances. It becomes even more serious when related to low-risk or routine businesses, like toll or contract manufacturers, distributors, or service providers, as these businesses would be expected to report a reasonable profit on a year-on-year basis.

Additionally, the difference may also occur by following outdated benchmarking results for pricing goods or services (not updated for the actual year).

Let’s understand this with an example:

Say there’s a Thai company that’s working as a contract research and development service provider solely to its US company (parent entity).

For rendering these services to the US company, the Thai company performs routine functions and assumes routine risks. As per the intercompany agreement, the US company pays the Thai company on a cost-plus 10 percent, and in turn, the Thai company invoices the US company quarterly. As a low-risk services provider, the Thai company is guaranteed a return on its cost.

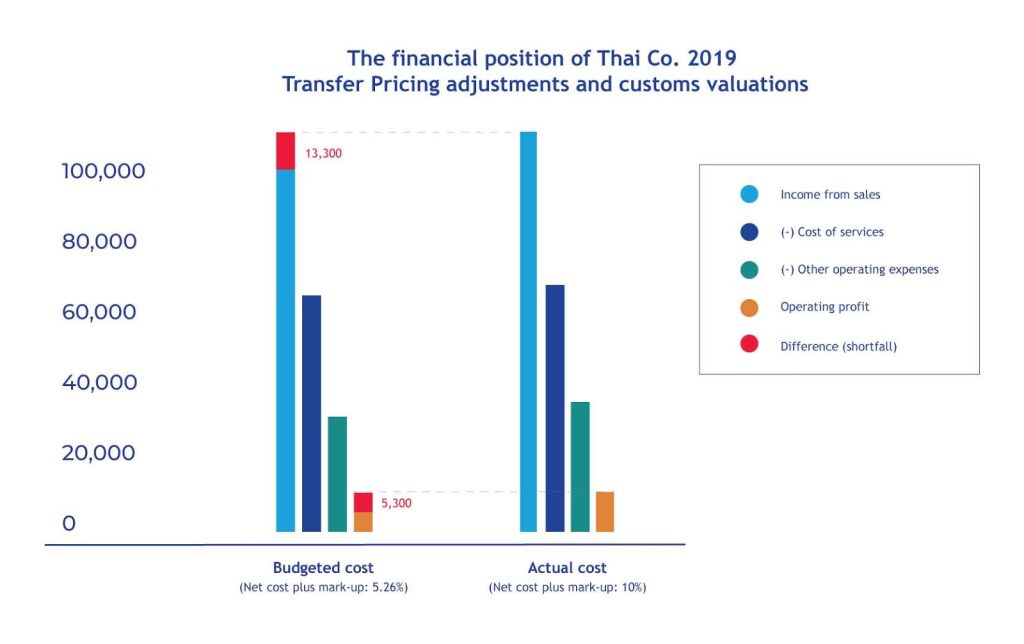

Here’s the financial position of the Thai company based on budgeted vs actual at the year-end:

As per the above example, the actual cost incurred by the Thai company is more than the budgeted cost. As such, it is essential to know what should be considered in the denominator (i.e. cost on which mark-up should be applied). As the Thai company is a captive service provider, ideally it should be remunerated on its actual cost. Therefore, the US company should have made a true-up adjustment to compensate the Thai company appropriately, consistent with the arm’s length principle.

Customs/VAT considerations

Transfer Pricing adjustments are intended to demonstrate the arm’s-length principle. But a lot of the time they have unintended implications from customs/VAT.

Imported products may pose a set of problems when undertaking Transfer Pricing adjustments to arrive at an arm’s-length result. They may end up differing from the initially declared values (for example, when the products were imported).

Such misalignment exposes multinationals to the risk of making additional custom/VAT payments or a shortfall/refund position.

The Thai Revenue Department recently introduced a Transfer Pricing disclosure form to identify these loopholes. Effective from the accounting period starting on or after 1 January 2019, any company (operating in Thailand) reporting revenue over 200 million Baht is required to complete it.

The data from the Transfer Pricing disclosure form could be shared and utilised by the Thai Customs Department to determine the accuracy of the declared value of imports.

It will, therefore, become essential for those importers to take a proactive approach and adjust prices to avoid misalignments and any potential issues. It’s also worth noting that failure to address these issues may expose multinationals to a more significant Transfer Pricing audit.

Mitigating risk

As everyone is now more interconnected than ever, any supposed ignorance of Transfer Pricing legislation may encourage tax authorities to open investigations beyond Transfer Pricing alone, extending their investigation into things like customs, corporate tax, or withholding.

Clearly, being prepared, and continuously reviewing and adjusting positions based on the latest Transfer Pricing benchmarking results is now essential. While it may not guarantee total risk avoidance, continuous review and adjustment will leave you better prepared for any special attention from the tax authorities.

That’s why we encourage multinationals to conduct regular Transfer Pricing analyses in advance, developing systematic strategies to address potential issues before they arise.

This way, multinationals can always ensure transactions between related parties can obtain reasonable profits without violating the arm’s-length principle, and offer appropriate profit to tax in the respective jurisdiction based on the functions, assets and risk analysis of the taxpayer.

When considering how HLB in Thailand can help you and your business, have a think about the following questions. We’re always here to help with the answers.

- When do you undertake these adjustments?

- How to make these adjustments?

- Are upward/downward adjustments permissible?

- Can you undertake multiple-year adjustments in a particular year?

- What’s the appropriate way to address the Transfer Pricing documentation?

- How do you address these issues in intercompany agreements?

- Do the Thai Revenue/Custom Departments take on these year-end adjustments?

- What are the industry’s best practices to tackle these year-end adjustments?

If you want to learn more about TP, check out our article “Everything you’ve ever wanted to know about Transfer Pricing in Thailand (with examples)”.

HLB’s Transfer Pricing specialists are here to help.

Thailand’s transfer pricing rules are complex, and can differ greatly from those in neighboring countries. To stay compliant,book a meeting with Rohit Sharma and his team of local transfer pricing experts at HLB Thailand today.

If you want to learn more about transfer pricing in Thailand, sign up to HLB Thailand’s 5 day email crash course here.