Thai rental properties and personal income tax

HLB Thailand Tax Team

Foreign investors looking to purchase rental properties in Thailand will often have the choice of purchasing the property in their own name or in an offshore company. The preferred ownership structure will require a careful analysis of the respective costs and benefits, taking into account the particular circumstances of the owner.

From a tax perspective, this will require consideration of the tax laws in Thailand as well as the tax laws in the owner’s home jurisdiction and an analysis of the impact on the investment returns after tax if an offshore company is interposed between the owner and the property.

An important tax issue to consider is the taxes payable on rental income.

Taxes on rental income

Foreign individuals are subject to Thai personal income tax on rental income generated from real estate situated in Thailand.

In most cases, 15% withholding tax applies to rental income paid to foreign individuals that are not tax residents of Thailand.

How to pay less than 15% tax

The tax withheld is not a final tax.

A foreign property owner residing outside Thailand could actually end up paying much less than 15% tax in Thailand if he has purchased the property in his own name.

For a foreigner to pay less than 15% tax on rental income, the first step will be to file personal income tax returns with the Thai Revenue Department to declare the rental income. The withholding tax deducted from rents can then be used as a tax credit to offset the tax payable on the return. The reward for filing a tax return is that the taxpayer can then request a refund of surplus withholding tax credits from the Thai Revenue Department.

Preparing and filing a personal income tax return in Thailand is not a difficult exercise.

A property owner is allowed a standard deduction of 30% against rental income, no questions asked. A personal taxpayer does have the option of claiming the actual expenses incurred in deriving the rental income which are necessary and reasonable, but the expenses claimed must be supported by documentary evidence, which may very well need to be furnished for audit before the tax refund is approved.

The refund is not automatic. You will need to specifically request a refund on the return otherwise the Revenue Department will not consider refunding the excess tax paid. if you don’t make the request on the return, it is still possible to make a request within 3 years of the return filing deadline.

Tax rates

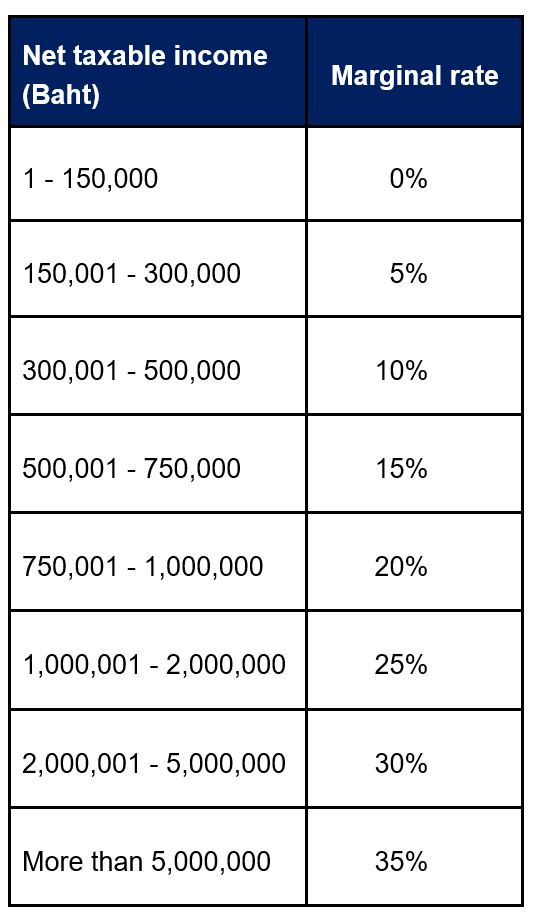

A personal taxpayer can earn net income up to Baht 150,000 (approx. USD 5,000) in a tax year and not pay income tax in Thailand. Unlike some countries that seek to tax foreigners at higher rates or deny them the tax free threshold, the tax scales for residents and non-residents are the same in Thailand.

Individuals are liable to personal income tax in Thailand on their net income, after deduction of expenses and allowances, at the following rates:

As the rates of tax are greater than 15% for net income over Baht 750,000 (approx. USD 25,000), there will come a point where the tax payable will be greater than the withholding tax credits.

By my reckoning, the property would need to be generating around USD 140,000 per annum in gross rentals before it came to the point where the withholding tax credits would not be enough to cover the income tax payable when the personal income tax return is filed.

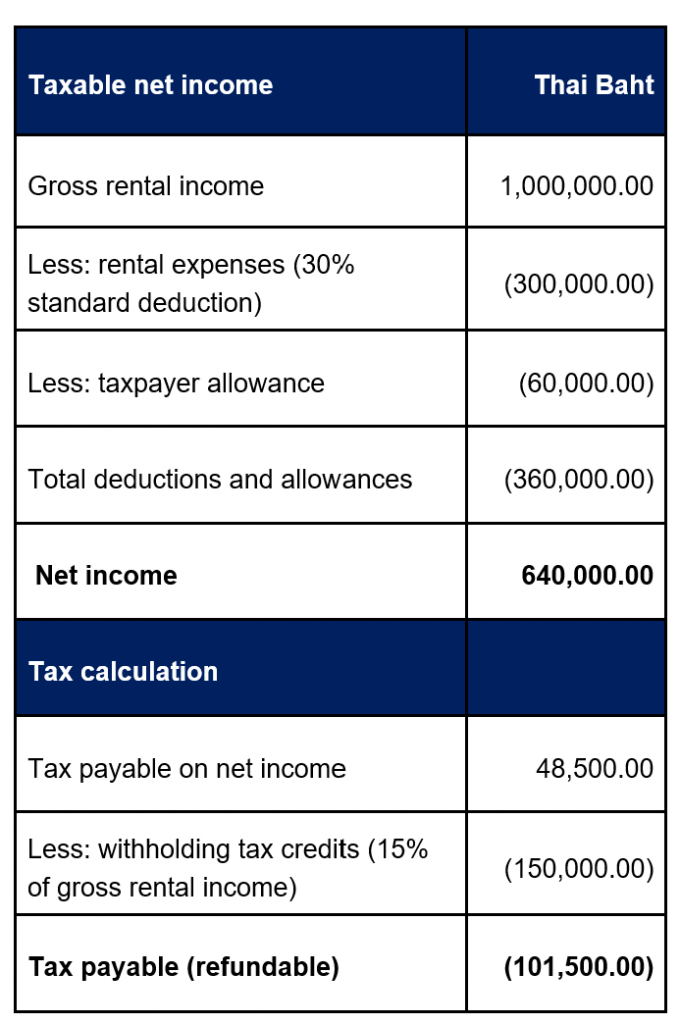

The benefit of filing a tax return is best illustrated by an example. Let’s take the case where a property generates gross rental income of Baht 1,000,000.00 (approx. USD 33,000) for the tax year. The following tax calculation for a typical property owner illustrates the potential tax refundable in this case.

The tax payable in this case is just under 5% of the gross rental income, resulting in more than two-thirds of the withholding tax deducted from rents during the year being refundable.

The figures speak for themselves and clearly demonstrate one distinct tax advantage for foreigners owning Thai rental properties in their own name.