HLB’s Survey of Business Leaders 2021 spotlights opportunities and challenges for the financial services sector in the wake of COVID-19

hlbthailand

HLB global recently conducted a survey of executives across multiple sectors to gauge confidence in global economic growth. The results of HLB’s survey shed light on many of the top challenges and opportunities facing the financial services industry in the wake of COVID-19.

As financial services uniquely reflect trends occurring across all other industries, the survey results discussed below should in fact provide value for executives of any stripe.

Here are just a few of the survey’s key findings at a glance:

- Only 20% of business leaders in financial services believe the rate of global economic growth is likely to increase over the next 12 months.

- Undertaking joint ventures is a priority for financial service executives

- Digital capabilities are a current weakness, but adopting emerging technologies presents a growth opportunity over the next 12 months

As lockdowns came into effect around the globe, the financial industry was quick to transition into online services. However, the shutdown of in-person banking posed serious difficulties for smaller and more rural institutions. Generational differences in consumer technology use, combined with less robust infrastructure, left some firms scrambling to adopt contactless technologies.

Continued restrictions on in-person financial services led to further revenue losses as business owners and consumers weren’t able to pay loans. The loss of trade and bond values and low interest rates affected profitability. Moreover, business owners began drawing on open credit lines, leaving financial institutions with less liquidity.

With interest rates expected to remain low, financial executives face a myriad of challenges in 2021.

HLB’s survey reflects this challenging environment and clarifies some of the financial industry’s top growth priorities, potential vulnerabilities, and future outlooks.

Financial executives are less optimistic about international growth prospects than their global peers, and only 12% say they’re very confident in their own growth prospects. Nonetheless, there’s a widespread consensus that emphasising growth tactics and risk reduction can help institutions navigate the current environment.

This applies as much to businesses operating here in Thailand as it does anywhere else.

The economy: Uncertainty lowers confidence

Institutions with less client diversity ran into more challenges during the pandemic than firms with assets balanced across multiple sectors.

Additionally, traditional financial services face overwhelming competition from fintech as global customer bases become more accustomed to contactless services in the era of COVID-19. This comes on top of existing trends toward digital-first consumer patterns.

Today’s clients are comfortable using online financial services to crowdsource funds or access loans without partaking in less convenient in-person banking processes. Add in concerns about regulatory changes, potential rising tax rates, and rock bottom interest rates, and technology averse firms in the financial sector have plenty to be concerned about.

Globally, 23% of business leaders believe global economic growth will increase. But, only 20% of financial executives feel the same way. In comparison, 26% of technology professionals and 25% of manufacturing leaders expect global economic growth to increase.

Like other business leaders, 87% of financial executives worry about economic uncertainty, and 78% express concerns over the impacts of COVID-19. The majority of financial leaders also acknowledge potential threats to growth, such as:

- 66% cite cybersecurity issues

- 65% mention tax risks

- 63% refer to regulatory change

- 62% specify social instability

The combination of security, regulations, taxes, COVID-19, and social instability can lead to less faith in growth prospects for individual institutions. Although 65% reported confidence in their own growth prospects over the next twelve months, this lags behind the global average of 75%.

Growth priorities for financial services leaders

Nearly all business sectors list improving operational efficiencies and reducing costs as key ways to grow this year.

Compared to other industries, 11% more financial services executives believe the adoption of emerging tech is critical to growth. Furthermore, financial professionals prioritise joint ventures and strategic alliances higher than their global peers, with 12% more making this a top priority.

Even before the pandemic, financial executives focused on mergers and partnerships to improve digital capabilities and expand their technological capacity. But a shift to remote work and client behavioural changes meant institutions had to speed up their digital transformations. Fintech firms, wealth management agencies, and the global payment sector now firmly rely on technology to provide secure client and employee tools.

To balance the costs of implementing emerging technologies and achieve growth, financial leaders understand they must reduce costs and improve efficiency by connecting with partners who can contribute both new tech and new customer bases.

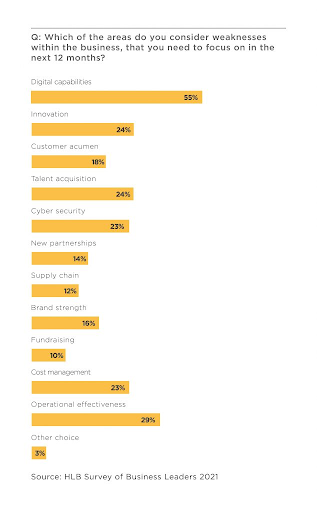

Analysing barriers to growth

55% of financial leaders say their existing digital capabilities are a weakness and believe that improving their technology is essential to growth. That means that most executives will concentrate on expanding their digital platforms in the coming 12 months.

The use of technology will also help leaders address noted vulnerabilities dealing with cybersecurity and talent acquisition.

To achieve results, 24% of respondents want to see more innovation, and 29% will focus on improving operational effectiveness.

Its worth noting that digital capabilities differ by segment.

The global payments industry takes the lead with contactless payment technologies supported by hefty fees for card-not-present (CNP) transactions. Meanwhile, wealth management companies look to increase access to big data analytics to generate client insights, track business performance, and deliver real-time investment advice. However, smaller institutions may prioritise consumer-facing technologies in rural areas, where 5G roll-outs may influence banking decisions.

Although many banks have already gone digital, handling the influx of big data and using it for business decisions is still a challenge. Smaller institutions will continue to look for ways to generate insights from existing data to select the right mix of products and services to increase client acquisitions and retention rates.

It’s also important to look at the impact of potential regulations and tax increases.

For example, the global payments industry saw rapid adoption of Europay, MasterCard, and Visa (EMV) technology in 2020. But many retailers are pushing back against exorbitant CNP fees. While the customer is paying in person, payment processors may charge the higher CNP fee. Increased pressure could result in regulatory changes, or business owners may seek out options with lower costs.

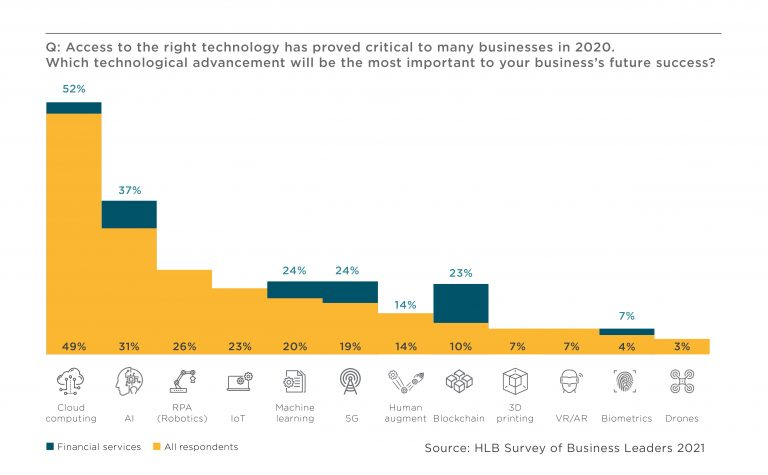

Future success relies on digital capability improvements

Cloud computing is a top priority for financial executives pursuing digital transformations. However, financial executives are less interested in the internet of things (IoT), virtual reality (VR), and augmented reality (AR) than global peers. Instead, financial services executives identified the following technological advancements as important to future business success:

- 37% artificial intelligence (AI)

- 25% machine learning (ML)

- 24% 5G technology

- 23% blockchain

Blockchain, AI, and ML

AI and ML both serve prominent roles in the financial industry, so increasing these capabilities is unsurprisingly considered vital.

There’s a growing demand for simple online processes with growth in platforms that tout speed and contactless methods for securing funds, approving applications, and transferring money into accounts. AI and ML can automate much of the back-office processes reducing human errors and operational costs.

In our global survey, only 10% of respondents consider blockchain essential to future business success, but a digital ledger of transactions presents many opportunities for financial leaders. While some worry about potential revenue losses, others aim to leverage the technology to improve existing systems and reach new markets. With support from prominent financial institutions, such as JP Morgan, Citigroup, PNC, and Wells Fargo, more organisations evaluate ways blockchain can enhance their digital assets.

Moving forward, many of these technologies will become less of a perk and more of a necessity. As 5G rolls out, financial institutions can use AI, ML, and blockchain to:

- Enable cross-border payments in real-time

- Reduce transaction costs and the paperwork required to transfer funds internationally

- Comply with anti-money laundering and know your customer (KYC) regulations

- Attract digital-first generations wanting convenience, transparency, and security

Accessing talent and increasing diversity

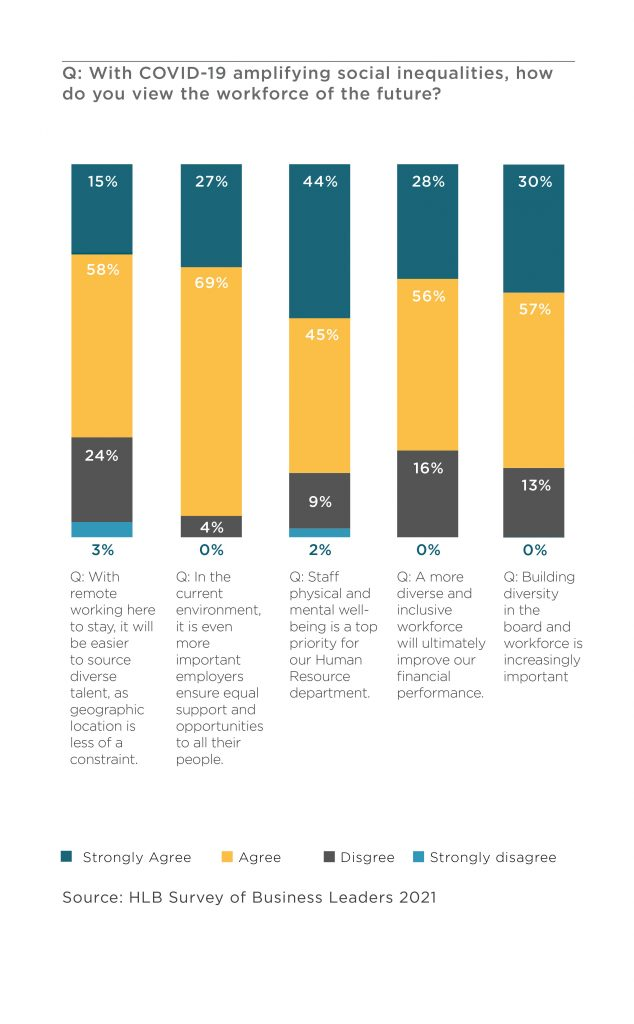

With financial leaders across all sectors listing talent acquisition as a weakness, finding new ways to attract and retain employees remains essential.

For many in the financial sector, a shift to remote work has helped break down barriers to talent acquisitions and opened the door to a vast pool of job candidates. Flexible work options allow business leaders to source talent with the skills needed for planned technology advancements. In fact, 73% of financial leaders expect remote work to make it easier to source diverse talent, compared to just 65% of their global peers.

Indeed, diverse talent is a must for financial services leaders, with 87% saying building diversity in the board and workforce is increasingly important and 84% saying that a more diverse and inclusive workforce will ultimately improve financial performance. Furthermore, 96% agree on the importance of ensuring equal support and opportunities, particularly in the current environment.

Greening of the financial services sector

88% of business leaders in financial services are making changes to their company to profit in the low-carbon economy, versus just 77% of their global peers, making it clear that the financial industry is already feeling the impact of climate change. Since the Network for Greening the Financial System (NGFS) formation in 2017, more executives are tuned into how climate change is affecting their organisations.

According to the Morgan Stanley Institute for Sustainable Investing, “Between 2016 and 2018, climate change-related weather events caused more than $630 billion in economic damage worldwide.” Some of the effects already being felt include defaults on loans in areas with extreme weather events, debtors impacted by environmental fines, and manufacturers in plastic or water-heavy segments losing business from new regulations and water shortages.

Going forward, 24% of leaders aim to take measures to protect asset values and create value through innovation. Moreover, 70% of financial services leaders are reassessing their supply chain to source closer to home.

Each of these steps may help executives increase operational efficiency and prepare their institution for climate change disruptions.

A new way of work

If COVID-19 has proven anything, it’s that staying connected and ensuring business continuity during disruption is absolutely vital.

Industry leaders believe they can leverage remote work to attract top talent, but many don’t feel an entirely remote workforce is the best solution. Furthermore, 86% agree that social distancing and remote working make it challenging to deploy the value of human touch in their businesses.

The top issues with remote work include:

-55% of respondents say remote work makes collaborative working harder

-42% believe it affects creativity

-42% think it dampens empathy

However, similar to other global leaders, 89% of financial services executives say physical and mental wellbeing is a top priority for human resource departments. With this in mind, the hybrid model is a way to support wellbeing while offering the flexibility craved by top talent.

Looking ahead with optimism

Although financial leaders keep a close eye on global and internal growth capabilities, they don’t doubt their expertise to navigate challenges. 94% of business leaders based in this sector are confident in their ability to successfully steer the business in a new direction in response to the impact of COVID-19.

With the possibility of future tax hikes, new regulations, and an increased focus on climate risks, financial service experts have their hands full. Intense focus on growth opportunities while increasing digital capabilities will allow institutions to cater to digital-first generations, mitigate risks, and remove barriers.

Methodology

Findings in this article are based on 93 survey responses from Financial Services business leaders collected in quarter 4 of 2020, as part of HLB’s Survey of Business Leaders 2021. The majority of businesses surveyed are privately or family owned. For the full research report see HLB’s Survey of Business Leaders 2021: Achieving the Post-Pandemic Vision: leaner, greener and keener.