What’s the difference between a Master file and a Local file?

Amit Bhalla , Principal, Transfer Pricing

In July 2017, the Organisation for Economic Co-operation and Development (OECD) incorporated and updated the guidelines on Transfer Pricing, aligning the recommendations from Action Plan 13 of the Base Erosion and Profit Shifting (BEPS) Inclusive Frameworks for Multinational Enterprises.

Understanding these changes is essential for taxpayers with related party transactions.

Under Chapter V of the 2017 OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations, a three-tiered approach to Transfer Pricing documentation has been incorporated for taxpayers with related party transactions.

The approach includes the preparation of three documents: Master File, Local File, and the Country-by-Country Report.

Why the three-tiered approach?

In order to standardise the Transfer Pricing documentation process, the three-tiered approach aims to:

Ensure taxpayers give appropriate consideration to Transfer Pricing requirements, to establish prices and other conditions for transactions between associated enterprises, and in reporting the income derived from such transactions in their tax returns. The goal is to:

- Provide tax administrations with the information necessary to conduct an informed Transfer Pricing risk assessment.

- Provide tax administrations with useful information to employ in conducting an appropriately thorough audit of the Transfer Pricing practices of entities subject to tax in their jurisdiction, although it may be necessary to supplement the documentation with additional information as the audit progresses.

These objectives provide guiding principles to both taxpayers and tax administrators.

With these guidelines, the taxpayers are able to:

- Prepare appropriate Transfer Pricing documentation.

- Carefully evaluate Transfer Pricing methodology at or before the time of filing a tax return, and the compliance with the applicable Transfer Pricing rules.

The tax administrators are able to:

- Assess the information needed to conduct a Transfer Pricing risk assessment, to make an informed decision on whether to perform a Transfer Pricing audit.

- Access or demand, on a timely basis, all additional information necessary to conduct a comprehensive audit.

What is a Master File?

There’s no getting around it. The OECD and G20s Transfer Pricing policies have made it mandatory for Multinational Enterprises to prepare a Master File.

The standard three-tiered approach requires Multinational Enterprises to articulate a high-level group overview along with the details of Transfer Pricing policies for their intercompany transactions.

This assists tax administrators to assess the Base Erosion and Profit Shifting related, or Transfer Pricing risks.

The Master File is a document containing high-level information about the global business operations, global supply chain, geographical locations (where the Group has footprints), description of the business activities of members of the Group, the Group’s intangibles, and financing arrangements within/outside the Group.

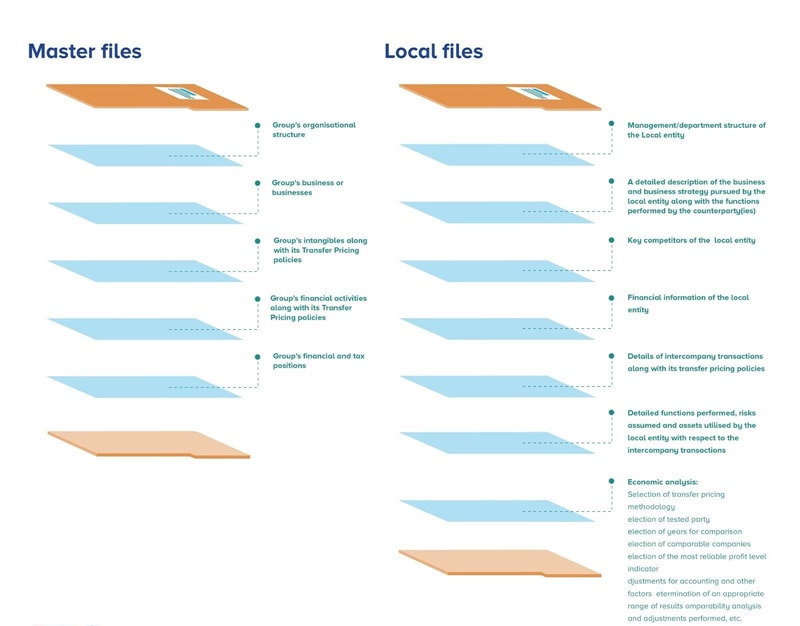

Chapter V of the OECD’s Transfer Pricing Guidelines requires the Master File to include:

- Group’s organizational structure

- Group’s business or businesses, including details about their supply and value chain

- Group’s intangibles, research & developments along with its Transfer Pricing policies

- Group’s financial activities along with its Transfer Pricing policies

- Group’s financial and tax positions (details of advance pricing arrangements etc.).

The Master File is to be prepared by the ultimate parent entity of the Group or a surrogate as appointed by the ultimate parent entity, within 12 months of its fiscal year-end or any country-specific requirement.

The Master File should be made available to all relevant tax authorities in the jurisdictions where the Group has a presence. Furthermore, the Master File may be prepared for the Group as a whole or on a segment basis, based on the specific guidance/requirement of the local jurisdiction.

The threshold for filings of the Master File

The threshold suggested by the OECD has consolidated group revenues equal to, or more than EURO 750 million or a near equivalent amount in domestic currency.

This threshold, however, varies across jurisdictions. In the Netherlands, for example, the threshold is exceeded if the consolidated group revenues are equal or over EURO 50 million.

In Indonesia, the threshold is exceeded if, during the previous year, one or more of the following is reached:

- Gross revenue is above IDR 50 billion

- Tangible goods of affiliated party transactions are above IDR 20 billion

- Any class of non-tangible goods related to party transactions are above IDR 5 billion

Or, if any of the related party transactions were with a tax jurisdiction, with a tax rate lower than the Indonesian corporate tax rate of 25%, in the current fiscal year.

The timeline for filings of the Master File

The OECD suggests that the Master File needs to be prepared within 12 months of the fiscal year-end.

For some countries, like Indonesia, the Master File will need to be prepared within four months of the end of the fiscal year.

It is, therefore, integral for Multinational Entities to consistently monitor local requirements.

What is a Local File?

A Local File is Transfer Pricing documentation already prepared in the local jurisdiction of a member of a Multinational Entity’s group.

While the Master File provides an overview, the Local File is more detailed. It’s an analysis of the local entity’s intercompany transactions, and is expected to be prepared and lodged with the local tax authority as per the local rules.

Although the requirements may vary from country to country, specified by the local tax authorities, typically, the Local File will contain the following:

- Management/department structure of the local entity

- A detailed description of the business and business strategy pursued by the local entity along with the functions performed by the counterparty(ies)

- Key competitors of the local entity

- Financial information of the local entity

- Details of intercompany transactions along with its Transfer Pricing policies

- Detailed functions performed, risks assumed and assets utilised by the local entity with respect to the intercompany transactions

- Economic analysis:

- Selection of Transfer Pricing methodology

- Selection of tested party

- Selection of years for comparison

- Selection of comparable companies

- Selection of the most reliable profit level indicator

- Adjustments for accounting and other factors

- Determination of an appropriate range of results

- Comparability analysis and adjustments performed, etc.

The thresholds and timelines for preparing and filing the Local File vary from country to country, so it’s crucial to have an understanding of the local legislation in each country an entity operates in.

The objective of the Local File is to ensure that the local entity is remunerated based on the functions it performs and risks it assumes with regard to the intercompany transaction(s), with the objective of satisfying the Arm’s Length principle.

Update on the Local File in Thailand

When it comes to preparing a Local File in Thailand, taxpayers need experts that know the local jurisdiction. Here’s how Thailand has updated the Local File requirements.

Arms Length

According to Section 65 bis (4) and Section 65 ter (15) of the Revenue Code, all transactions are to be undertaken at an Arm’s Length price.

It also provides specific powers to the assessment officers to impose Transfer Pricing adjustments in respect of income or expenses arising from non-Arm’s Length transactions.

The Instruction

In 2002, specific Transfer Pricing guidelines were issued in the form of Departmental Instruction No. Paw 113/2545 – also known as “the Instruction”.

The Instruction provides the assessing officers with guidelines for interpreting the existing Transfer Pricing laws when conducting tax examinations, and outlines the approach that taxpayers should follow when establishing Transfer Prices.

The Instruction is, broadly speaking, consistent with the OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations.

The recent addition of the “Notification of the Director-General of the Revenue Department on Income Tax (No.400)”, provides further clarity for taxpayers about the transfer pricing documentation they’re expected to maintain. It is effective for accounting periods commencing on or after 1 January, 2021.

New provisions

Recently, the National Legislative Assembly strengthened the enforcement of Transfer Pricing regulations by adding more provisions to the Revenue Code.

This included Section 71 bis, Section 71 ter, and Section 35 ter.

Section 71 bis defines the term “related parties” and authorises the assessment officers to assess and adjust the revenue and expenses of such companies with related parties when they’re not being priced appropriately. The pricing of transactions should be determined as if the related companies were acting independently of each other.

Section 71 ter requires companies with revenue exceeding THB 200 million in an accounting year to submit a Transfer Pricing disclosure form and prepare supporting documentation together with its annual corporate income tax return (PND 50) for accounting periods commencing on or after 1, January 2019.

Entities failing to comply with the legislation are subject to a penalty of no more than 200,000 baht as stipulated in Section 35 ter.

Our observations

Since joining the OECD’s BEPS Inclusive Framework, Thailand has committed to implementing the four minimum standards of its package, including the three-tiered Transfer Pricing documentation structure, Country by Country report, Master File, and Local File as mandated by the Action Plan 13.

Taxpayers will need to ensure that they can demonstrate the substance behind their existing tax structures and arrangements, especially if those structures have transactions with low tax jurisdictions.

For further insight on Thailand’s most up to date approach to Transfer Pricing documentation, refer to our article on implications of the recent “Notification of the Director-General of the Revenue Department on Income Tax (No.400)”.

This additional information will help the Revenue Department assess whether activities undertaken by the taxpayer in relation to the counterparty to the transaction support the Transfer Pricing policies and the Arm’s Length principle.

The tax administrators will want to analyse the current Transfer Pricing policies in order to conduct an informed Transfer Pricing risk assessment, determining where to target their Transfer Pricing audit activity.

On 13 April, 2020, the Thai Revenue Department released a public consultation document on the Country by Country report.

We believe that the law will be introduced shortly and should conform to the global standard of the three-tiered approach.

Watch this space for our comments on the public consultation document released by the Thai Revenue Department on Country by Country report.

If you want to learn more about Transfer Pricing, check out our article “Everything you’ve ever wanted to know about Transfer Pricing in Thailand (with examples)”.

HLB’s Transfer Pricing specialists are here to help.

Thailand’s transfer pricing rules are complex, and can differ greatly from those in neighboring countries. To stay compliant,book a meeting with Amit Bhalla and his team of local transfer pricing experts at HLB Thailand today.

Read More: The impact of COVID-19 on your Transfer Pricing arrangements